Every business, whether a startup or an established company, needs financial support to grow. One of the biggest challenges entrepreneurs face is securing the right funding. Traceloans.com business loans provide businesses with tailored financial solutions that cater to their unique needs. From small business loans to working capital funding, Traceloans.com offers various options to help businesses thrive.

This in-depth guide explores everything you need to know about Traceloans.com business loans, including loan types, eligibility criteria, the application process, benefits, and expert tips to improve approval chances. By the end of this article, you will have a complete understanding of how to use these loans to strengthen and grow your business.

What Are Traceloans.com Business Loans?

Traceloans.com is an online lending platform designed to provide businesses with fast and flexible financing. Whether you need money to start a business, buy equipment, or manage daily expenses, their business loans offer practical solutions.

Unlike traditional banks that require extensive paperwork and long processing times, Traceloans.com simplifies the lending process. The company focuses on small and medium-sized businesses that may struggle to get funding from conventional banks.

Entrepreneurs choose Traceloans.com business loans because of:

- Quick loan approval with minimal paperwork

- Flexible repayment terms that suit different financial situations

- Competitive interest rates that make repayment easier

- Loans designed for startups with limited financial history

Types of Business Loans Offered by Traceloans.com

Traceloans.com provides different types of loans tailored to the specific needs of businesses. Choosing the right loan depends on factors like your business type, financial history, and the purpose of the loan.

1. Startup Business Loans

Starting a business requires significant investment, but new businesses often struggle to secure funding due to a lack of financial history. Traceloans.com business loans for startups help new entrepreneurs cover essential costs like office space, inventory, marketing, and operational expenses.

Unlike traditional banks that require high credit scores and collateral, Traceloans.com offers startup-friendly loan options with lower requirements. This makes it easier for first-time business owners to get the funding they need.

2. Small Business Loans

Small businesses need continuous financial support to expand and stay competitive. Whether it’s hiring employees, purchasing inventory, or launching a marketing campaign, small business loans help entrepreneurs maintain steady growth.

Traceloans.com small business loans come with flexible repayment terms and reasonable interest rates, ensuring that businesses don’t face financial strain while repaying their loans.

3. Working Capital Loans

Cash flow problems are common in businesses, especially those dealing with seasonal demand. Working capital loans provide short-term financial assistance to help businesses manage daily expenses like rent, salaries, and utilities.

These loans are ideal for businesses that experience fluctuating revenue and need funds to maintain operations during slow periods.

4. Equipment Financing

Businesses in industries like manufacturing, healthcare, and construction require expensive equipment to operate. Equipment financing allows companies to acquire necessary machinery without paying a large upfront cost.

Instead of buying equipment outright, businesses can spread the cost over time while benefiting from the new tools. This option is useful for businesses that need to upgrade technology without disrupting their cash flow.

5. Invoice Factoring

Many businesses face delayed payments from clients, which can lead to cash flow issues. Invoice factoring helps businesses receive immediate cash by selling unpaid invoices to a lender at a discount.

This allows businesses to maintain smooth operations without waiting weeks or months for client payments.

Get More Information: Statekaidz-com

How to Apply for a Traceloans.com Business Loan

Applying for a business loan from Traceloans.com is a straightforward process. Unlike banks that require complex paperwork, Traceloans.com simplifies the procedure to ensure businesses receive funding as quickly as possible.

Step 1: Determine Your Loan Requirements

Before applying, assess your business needs. Identify the amount of funding required and the purpose of the loan. Having a clear financial plan improves your chances of approval.

Step 2: Check Eligibility Criteria

Ensure you meet the lender’s basic requirements. Traceloans.com considers factors such as:

- Business age (at least six months for most loans)

- Monthly revenue (varies by loan type)

- Credit history (higher scores improve approval chances)

- Business plan (essential for startups)

Step 3: Gather Necessary Documents

Prepare documents such as:

- Business registration details

- Financial statements

- Tax returns

- A detailed business plan

Step 4: Submit an Online Application

Visit the Traceloans.com website and fill out the loan application form. Provide accurate details about your business, financial history, and loan purpose.

Step 5: Loan Approval and Fund Disbursement

Once your application is submitted, lenders review your information. If approved, funds are deposited into your business account within a few days.

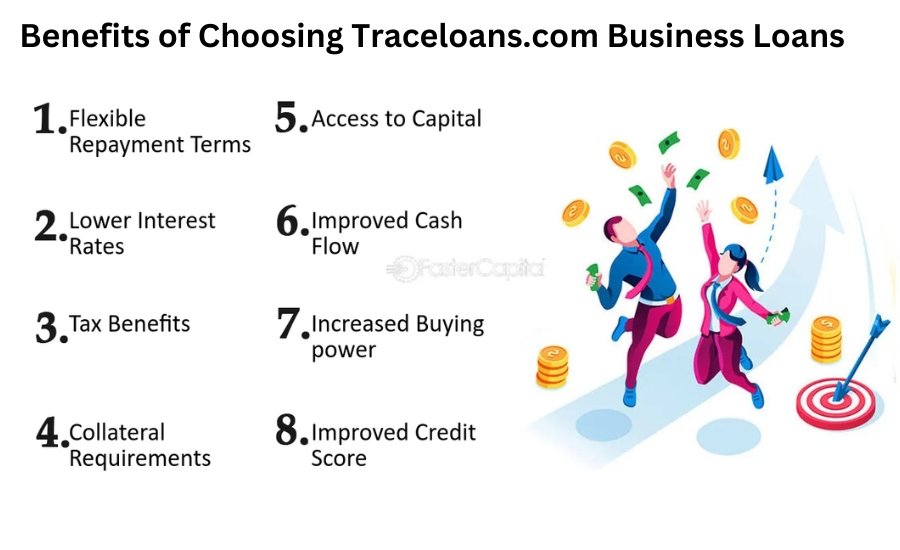

Benefits of Choosing Traceloans.com Business Loans

Traceloans.com provides several advantages over traditional lenders, making it a preferred choice for business owners.

1. Faster Loan Approval

Unlike banks that take weeks to approve loans, Traceloans.com processes applications quickly. Entrepreneurs can receive funds within a few business days, ensuring they don’t miss out on growth opportunities.

2. Flexible Repayment Terms

Businesses can choose repayment terms that suit their financial situation. This flexibility helps companies manage loan repayments without financial strain.

3. Competitive Interest Rates

Traceloans.com offers reasonable interest rates, making it easier for businesses to repay their loans without accumulating excessive debt.

4. No Collateral Required for Some Loans

Startups and small businesses often struggle to provide collateral. Certain Traceloans.com business loans do not require assets as security, making it easier for more businesses to qualify.

Challenges in Securing a Business Loan and How to Overcome Them

While Traceloans.com simplifies the lending process, some businesses still face challenges in securing loans. Understanding these obstacles and taking proactive steps can increase approval chances.

Low Credit Score

Lenders assess credit history to determine loan eligibility. A low credit score can reduce approval chances. To improve your credit score:

- Pay bills on time

- Reduce existing debt

- Monitor your credit report for errors

Insufficient Business Revenue

Many lenders require a minimum revenue threshold. If your business revenue is low, consider applying for a smaller loan or improving your financial statements before applying.

Lack of a Solid Business Plan

A well-structured business plan reassures lenders of your ability to repay the loan. Clearly outline your business model, revenue projections, and growth strategies to improve approval chances.

Conclusion

Securing the right funding is crucial for business success. Traceloans.com business loans offer reliable financial solutions for startups, small businesses, and growing enterprises. By choosing the right loan type and preparing a strong application, entrepreneurs can access the funds they need to expand and sustain their businesses.

If you’re looking for a fast, flexible, and efficient business loan provider, Traceloans.com is a great option. Their streamlined application process, competitive rates, and business-friendly terms make them a preferred choice for entrepreneurs.

Before applying, ensure your business meets the eligibility criteria and prepare all necessary documents. A well-planned loan application increases your chances of securing funding and successfully growing your business.

FAQS

Q: What types of business loans does Traceloans.com offer?

A: Traceloans.com offers startup loans, small business loans, working capital loans, equipment financing, and invoice factoring.

Q: How long does it take to get approved for a Traceloans.com business loan?

A: Approval times vary, but most loans are processed within a few business days, with funds deposited shortly after approval.

Q: Do I need collateral to apply for a loan with Traceloans.com?

A: Some loans require collateral, but many options, especially for startups and small businesses, do not require assets as security.

Q: What credit score is needed to qualify for a Traceloans.com business loan?

A: A higher credit score improves approval chances, but Traceloans.com also considers business revenue and financial history.

Q: Can startups with no financial history apply for a loan?

A: Yes, Traceloans.com provides startup business loans, though applicants may need a strong business plan to qualify.

Read More: Thefurikake.com