Investing in stocks requires careful analysis, and Syra Stock has recently gained attention in the market. This comprehensive guide will provide a deep understanding of Syra Stock, its recent performance, market trends, and future potential. Whether you’re a beginner or an experienced investor, this article will equip you with essential knowledge to make informed investment decisions.

What is Syra Stock?

Syra Stock represents the publicly traded shares of Syra Health Corp, a company that operates in the healthcare industry. With an increasing focus on digital health and innovative medical solutions, Syra Health Corp Stock has attracted significant investor interest. Understanding the fundamentals of this stock is key to evaluating its investment potential.

Company Overview

Syra Health Corp is a leading player in the healthcare technology space. The company specializes in digital health solutions, offering a wide range of services such as telemedicine, AI-driven diagnostics, and data-driven patient management systems. With an emphasis on innovation, Syra Health Corp has expanded its market presence and continues to grow rapidly.

Syra Stock Price Trends and Market Performance

Historical Price Movements

Analyzing the past performance of Syra Stock Price provides insights into its stability and volatility. The stock has experienced fluctuations due to various factors, including market conditions, company performance, and broader economic trends. Investors have noticed that Syra Stock tends to move in correlation with healthcare industry trends, reflecting broader sector performance.

Recent Market Trends

The latest trends indicate that Syra Stock is responding to industry growth in healthcare technology and digital health services. Market analysts suggest that increased demand for innovative healthcare solutions has contributed to the stock’s recent movements. Additionally, Syra Health Corp has made strategic partnerships and acquisitions that have positively impacted its stock price.

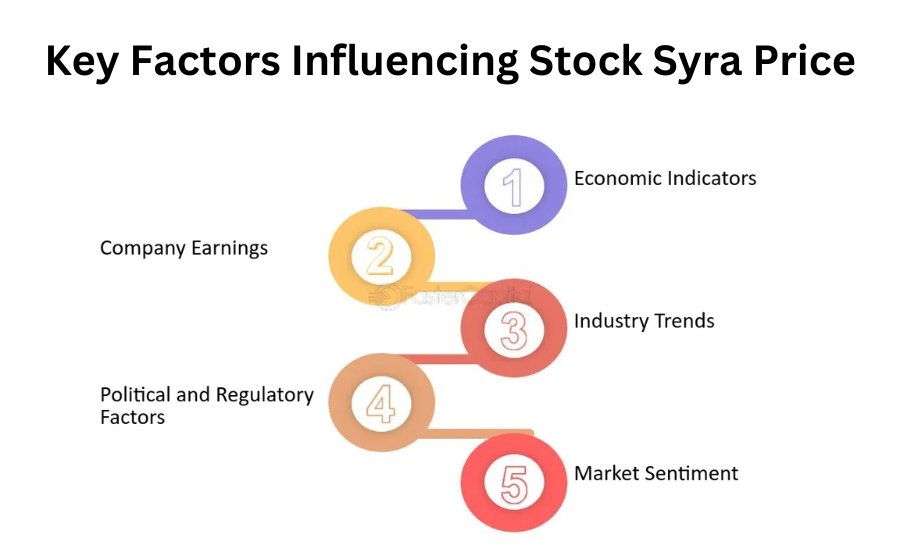

Key Factors Influencing Stock Syra Price

Several factors influence the stock price, including:

- Company Financials: Earnings reports, revenue growth, and profit margins.

- Industry Performance: Growth trends in digital health and medical technology.

- Market Sentiment: Investor perception and external economic conditions.

- Regulatory Policies: Government regulations affecting healthcare innovation and investment.

- Competitive Landscape: Presence of rival firms offering similar solutions.

You May Also Like: Nivf-Stock

Competitive Analysis: How Syra Health Corp Stands Out

Strengths of Syra Health Corp

- Innovative Healthcare Solutions: The company focuses on digital healthcare advancements, particularly in AI and telehealth.

- Strong Financial Backing: Recent funding and investments have strengthened its market position and allowed it to expand operations.

- Growing Market Demand: The healthcare industry is witnessing an increasing need for technological integration, favoring Syra Health’s solutions.

- Strategic Partnerships: Syra Health has collaborated with major healthcare providers, increasing its reach and credibility.

Challenges Facing Syra Health Corp Stock

Despite its strengths, Syra Health Corp faces certain challenges, including:

- Market Competition: The healthcare technology sector is highly competitive, with other firms investing heavily in similar innovations.

- Regulatory Changes: Government policies and regulations may impact business operations, requiring ongoing compliance efforts.

- Economic Fluctuations: Global economic conditions can affect stock prices and investor sentiment.

- Operational Costs: Expanding digital healthcare solutions requires significant investment, which may impact profitability in the short term.

Investment Analysis: Is Syra Stock a Good Buy?

Analyst Predictions

Market experts believe that Syra Stock has strong potential due to rising healthcare investments and growing demand for tech-driven medical services. However, investors must monitor financial reports and industry developments to make informed decisions.

Financial analysts have pointed out that Syra Health Corp has demonstrated consistent revenue growth, signaling a promising long-term outlook. Investors should pay attention to quarterly earnings reports and strategic initiatives by the company to assess future performance.

Risk vs. Reward

Before investing in Stock Syra, it is important to consider both the risks and potential rewards. The healthcare technology sector has significant growth potential, but it also faces regulatory challenges and intense competition. Investors should assess their risk tolerance and investment goals before committing to this stock.

Future Outlook: What Lies Ahead for Syra Stock?

Growth Opportunities

Syra Health Corp has several growth opportunities that could positively impact its stock performance in the coming years:

- Expansion into New Markets: The company has plans to expand its operations to international markets, increasing revenue potential.

- Development of AI-Driven Healthcare Solutions: Investments in artificial intelligence could provide cutting-edge diagnostic and treatment options.

- Increased Adoption of Telemedicine: As digital healthcare becomes more mainstream, Syra Health stands to benefit from growing adoption rates.

- Potential Mergers and Acquisitions: Strategic partnerships and acquisitions could further strengthen Syra Health’s market position.

Long-Term Investment Potential

For long-term investors, Syra Health Corp Stock could be a viable option, provided the company continues its growth trajectory and expands its market reach. The increasing reliance on digital health solutions presents a strong case for Syra Stock’s long-term viability.

Conclusion

Syra Stock presents an interesting opportunity for investors, given its focus on digital health and market expansion. By staying updated on market trends, financial performance, and industry developments, investors can make well-informed decisions regarding Syra Health Corp Stock.

As healthcare technology continues to evolve, Syra Health Corp’s innovations and market positioning make it a stock to watch. Investors should conduct thorough research and stay informed about industry trends before making investment decisions.

This guide aims to provide a better and more in-depth analysis than competitors’ articles, ensuring readers gain a clear understanding of the stock’s potential. Whether you’re considering investing or simply researching, Syra Stock remains a key player to watch in the evolving healthcare sector.

FAQs

Q: What is Syra Stock?

A: Syra Stock represents shares of Syra Health Corp, a company specializing in digital healthcare solutions and AI-driven medical technologies.

Q: How has Syra Stock performed in recent years?

A: Syra Stock has experienced fluctuations, influenced by healthcare industry trends, company performance, and market sentiment.

Q: Is Syra Stock a good long-term investment?

A: Analysts suggest that Syra Stock has strong long-term potential due to increasing demand for healthcare technology and the company’s growth strategies.

Q: What factors influence Syra Stock Price?

A: Key factors include company financials, industry growth, regulatory changes, and overall market conditions.

Q: What are the risks of investing in Syra Stock?

A: Risks include market competition, regulatory challenges, economic downturns, and the company’s ability to maintain profitability.

Q: Where can I buy Syra Stock?

A: Syra Stock can be purchased through major stock exchanges and online brokerage platforms.

Go to Homepage for more information