Over the past decade, the financial technology (fintech) industry has undergone a significant transformation, particularly in FintechAsia Sombras. This region, home to the world’s fastest-growing economies, has become the epicenter of fintech innovation. With its rapidly expanding population and high technological adoption, Asia has created fertile ground for fintech companies to thrive. Among these, FintechAsia Sombras stands out as a true pioneer, revolutionizing the way financial services are delivered.

In this article, we will explore the remarkable journey of FintechAsia Sombras, its market impact, innovative services, and the role it plays in shaping the future of financial services in Asia. With a focus on financial inclusion, cutting-edge technology, and addressing the needs of underserved populations, Sombras FintechAsia has emerged as a game-changer in the region’s financial landscape.

The Rise of Fintech in Asia: A Thriving Landscape

Asia’s rapid economic development, technological advances, and large unbanked population have created a unique environment for fintech growth. Countries like China, India, Singapore, and Indonesia have become global hotspots for fintech innovation. With increasing internet penetration, mobile device usage, and government support for digital initiatives, fintech startups have flourished in Asia.

Why Asia Is Ideal for Fintech Innovation

- Large Unbanked Population: One of the key drivers of fintech development in Asia is the significant number of people who do not have access to traditional banking services. According to a World Bank report, over 1.7 billion adults globally remain unbanked, with Asia accounting for a substantial portion of this number. FintechAsia Sombras has harnessed the power of technology to provide financial services to these underserved populations, improving financial inclusion.

- Rapid Technology Adoption: The adoption of smartphones and the internet has skyrocketed in Asia, providing fintech companies with an extensive platform to reach consumers. With increasing access to technology, people in remote areas can now access banking services, transfers, and other financial products.

- Supportive Government Initiatives: Governments across Asia are embracing digital transformation in financial services. Countries like Singapore and India have implemented regulations that encourage the growth of fintech by promoting transparency, security, and innovation.

The Birth of FintechAsia Sombras

In this fertile landscape, FintechAsia Sombras was born with a mission: to provide accessible and innovative financial solutions to millions of people across Asia. The company’s founders, a team of expert entrepreneurs and technologists, saw the potential of fintech to bridge the gap between traditional banking institutions and the unbanked population.

From its inception, Sombras FintechAsia aimed to leverage cutting-edge technologies such as artificial intelligence (AI), blockchain, and big data analytics to develop tailored financial products that cater to the unique needs of the Asian market.

Innovative Services and Solutions by Sombras FintechAsia

FintechAsia Sombras has introduced a range of groundbreaking services that set it apart from traditional financial institutions. Below are the key offerings that have made it a leader in the Asian fintech landscape.

Sombras Pay: A Seamless Payment Solution

Sombras Pay is an all-encompassing payment platform that allows users to send money, make payments, and manage their finances effortlessly using a smartphone. This mobile app is designed with simplicity and accessibility in mind, making it easy for people from diverse backgrounds to use it.

- User-Friendly Interface: With an intuitive interface, Sombras Pay allows users to send money, pay bills, and transfer funds without the complexities of traditional banking systems.

- Multiple Payment Options: Users can link their bank accounts, credit/debit cards, or mobile wallets to the app, enabling multiple payment options.

- Enhanced Financial Literacy: Beyond payments, FintechAsia Sombras has worked to improve financial literacy by providing users with educational resources on budgeting, savings, and managing personal finances.

Sombras Capital: Empowering SMEs with Digital Lending

Small and Medium Enterprises (SMEs) play a critical role in driving economic growth and job creation across Asia. However, these businesses often struggle to secure financing from traditional banks due to strict requirements and lengthy approval processes.

To address this gap, FintechAsia Sombras introduced Sombras Capital, a digital lending platform designed specifically for SMEs. By leveraging data-driven algorithms and machine learning, Sombras Capital has transformed the lending process, making it faster, more efficient, and accessible to a wider range of businesses.

- Real-Time Credit Scoring: The platform uses AI to assess the creditworthiness of SMEs quickly and accurately, enabling faster loan approvals.

- Paperless Process: Sombras Capital offers a completely digital and paperless application process, ensuring that SMEs can apply for loans without the cumbersome documentation required by traditional banks.

- Flexible Repayment Plans: The platform offers flexible loan repayment options, allowing SMEs to choose terms that best fit their cash flow needs.

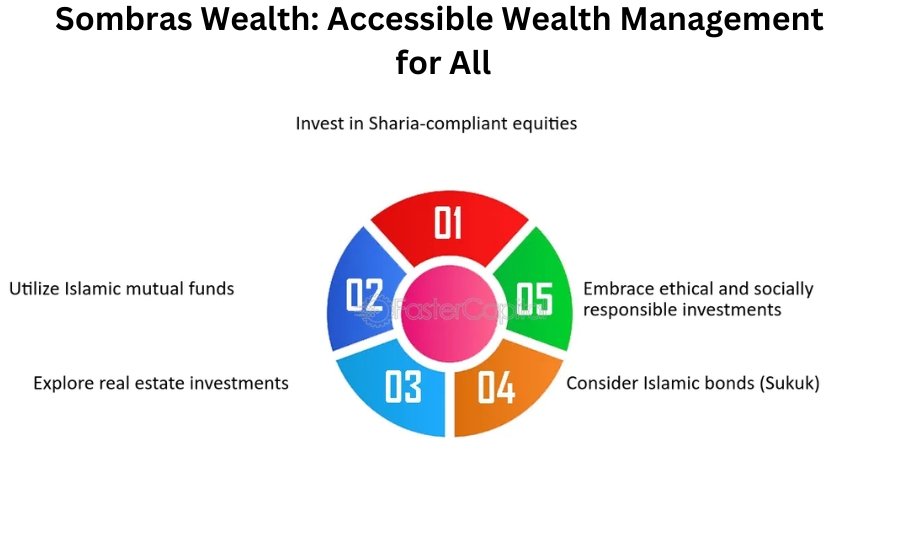

Sombras Wealth: Accessible Wealth Management for All

Wealth management has traditionally been reserved for the wealthy or those with significant financial resources. However, FintechAsia Sombras is breaking down this barrier with its wealth management platform, Sombras Wealth.

- AI-Powered Investment Solutions: Sombras Wealth uses artificial intelligence and machine learning to recommend personalized investment portfolios based on users’ financial goals, risk tolerance, and investment time horizons.

- Mutual Funds and Bonds: Users can invest in a range of assets, including mutual funds, shares, bonds, and ETFs, with the platform offering guidance for those new to investing.

- Robo-Advisory Services: For those who prefer automated solutions, Sombras Wealth provides robo-advisory services, which offer algorithm-driven financial planning advice without the need for a human advisor.

FintechAsia Sombras and Financial Inclusion

At the heart of FintechAsia Sombras lies a deep commitment to promoting financial inclusion. By offering a broad range of affordable financial services, the company has helped millions of people who were previously excluded from the financial system.

- Mobile Banking Initiatives: Through collaborations with local governments and institutions, Sombras FintechAsia has launched mobile banking services in rural areas, giving unbanked populations access to essential financial services.

- Microfinance Programs: The company supports microfinance initiatives to help individuals start small businesses and improve their livelihoods.

Impact on the Asian Market: Revolutionizing Financial Services

The introduction of FintechAsia Sombras has had a profound impact on the Asian financial services market. The company’s innovative approach to digital banking, lending, wealth management, and payments has revolutionized how people in Asia access and manage their finances.

Boosting Economic Growth

By offering accessible financial products to SMEs and individuals, Sombras FintechAsia has played a crucial role in boosting economic growth across the region. SMEs, which are vital to job creation and GDP growth, now have access to financing options that were previously out of reach. Additionally, by promoting financial literacy and inclusion, FintechAsia Sombras has contributed to creating a more financially responsible and empowered population.

Building Trust and Reliability

As a company deeply committed to user-centric innovation, Sombras FintechAsia has built a reputation for providing secure, reliable, and efficient financial solutions. The company’s focus on security, transparency, and customer support has earned it the trust of millions of users across Asia.

The Future of FintechAsia Sombras: A Vision for Continued Growth

Looking ahead, FintechAsia Sombras is well-positioned to expand its reach and continue driving innovation in the fintech space. The company plans to:

- Expand Into New Markets: With its success in Asia, FintechAsia Sombras is eyeing expansion into other emerging markets, bringing its innovative solutions to new populations.

- Enhance AI and Blockchain Integration: The company will continue to leverage cutting-edge technologies such as AI and blockchain to further streamline processes and improve the user experience.

- Focus on Sustainability: FintechAsia Sombras is also committed to promoting sustainable financial practices by introducing green investments and funding for eco-friendly startups.

Conclusion

FintechAsia Sombras is not just another fintech company; it is a catalyst for change in the financial services sector. By embracing technology, innovation, and financial inclusion, Sombras FintechAsia has made a significant impact on millions of lives across Asia. With its user-friendly solutions, commitment to economic growth, and vision for the future, FintechAsia Sombras is poised to continue shaping the fintech landscape and empowering individuals and businesses alike.

Read More: TheFurikake