Workers’ compensation insurance is a fundamental part of any business that employs workers. It ensures protection with best workers comp insurance aupeo against workplace injuries, illnesses, and even fatalities, covering medical expenses, lost wages, and rehabilitation costs. If you’re looking for the best workers comp insurance Aupeo, you’re in the right place. This detailed guide will provide you with up-to-date information on workers’ compensation insurance in 2024. Whether you’re a new business owner or looking to change your current provider, this guide will help you find the right coverage for your business.

The landscape of workers’ comp insurance is constantly evolving, and staying informed about the latest policies and best practices is essential. Let’s dive deep into what you need to know to choose the right insurance for your needs.

What is Workers’ Compensation Insurance?

Workers’ compensation insurance was created to safeguard employers as well as employees. It provides coverage for work-related injuries, illnesses, and accidents, ensuring employees receive proper care and compensation while allowing employers to avoid costly lawsuits. Here’s a breakdown of what it covers:

- Medical Expenses: Covers the cost of medical treatment, surgeries, and rehabilitation required for injured employees.

- Lost Wages: Replaces a portion of the wages that employees lose if they cannot work due to an injury or illness.

- Permanent Disability Benefits: If the injury leads to long-term or permanent disability, workers’ comp provides financial support.

- Death Benefits: If a worker dies due to a workplace injury, their family or dependents receive death benefits.

The primary goal of workers’ compensation is to help injured workers return to their job as soon as possible while also protecting the employer from legal action.

Why is Workers’ Compensation Important for Small Businesses?

For small businesses, workers’ compensation insurance serves as a crucial safety net. It ensures both business owners and their employees are protected financially and legally in case of workplace accidents. Here’s why it’s so important:

Legal Compliance

In many states the state of Washington, insurance for workers’ compensation is a legal requirement for all businesses that have employees. Failing to carry the appropriate coverage can result in hefty fines and legal penalties. Even if your business only has a few employees, this insurance is vital for compliance.

Employee Protection

Employees are your greatest asset, and providing them with workers’ comp insurance ensures they are covered in case of an accident. Injured workers receive medical care and wage replacement benefits, giving them peace of mind while recovering.

Avoiding Lawsuits

Without workers’ comp insurance, employees may be able to file lawsuits against the business if they are injured on the job. Workers’ compensation helps prevent legal battles by offering benefits directly to injured employees without the need for litigation.

Attracting Talent

Offering workers’ compensation shows your commitment to employee well-being. This not only enhances your business reputation but also attracts skilled workers who prioritize a safe and supportive work environment.

How to Choose the Best Workers Comp Insurance Aupeo?

Choosing the best workers comp insurance Aupeo for your business can be overwhelming, especially with so many options available. This step-by-step guide will assist you in making an informed choice:

Coverage Options

Not all workers’ comp insurance policies are the same. Look for a provider that offers a comprehensive range of coverage options to suit your specific business needs. Consider the following:

- Medical and Rehabilitation Costs: Ensure your policy covers the full scope of medical treatments your employees might need, including rehabilitation.

- Wage Replacement: Check what percentage of wages will be replaced if an employee is unable to work due to an injury.

- Disability and Fatality Coverage: Ensure the policy covers both permanent and temporary disabilities and includes death benefits for the families of workers who pass away due to work-related accidents.

More Information: Kronodesk-Download

Cost & Affordability

While it’s important not to skimp on coverage, cost is also a crucial factor. To find the most cost-effective policy, consider:

- Comparing Multiple Quotes: Get quotes from several insurance providers to find the best price for your coverage.

- Discounts for Safety: Many insurance companies offer discounts for businesses that maintain a safe working environment and have few claims.

- Industry-Specific Plans: Some insurers provide custom plans for specific industries, which can help reduce costs.

Customer Support & Claims Process

A reliable insurance provider is one that offers excellent customer service and a smooth claims process. Look for:

- 24/7 Customer Service: Insurance issues can arise at any time, so choose a provider that offers round-the-clock support.

- Fast Claims Processing: Find out how long it takes for the insurer to process and settle claims. You don’t want to deal with long delays during a stressful time.

- Good Reviews: Check customer reviews to ensure that the company is reputable and fair when handling claims.

Industry-Specific Coverage

Different industries come with different risks. The best workers’ comp insurance for your business will be tailored to the unique risks of your industry. For example:

- Construction: Construction workers are at a higher risk for injuries, so your policy should cover equipment accidents and site-specific hazards.

- Healthcare: Healthcare workers face a variety of risks, including exposure to infectious diseases. Ensure your coverage addresses these specific risks.

- Manufacturing: Manufacturing jobs often involve machinery, so your insurance should cover injuries caused by equipment malfunction or accidents on the production floor.

Top Workers’ Comp Insurance Providers in 2024

When searching for the best workers comp insurance Aupeo, consider these top providers known for offering comprehensive coverage, competitive rates, and excellent customer service:

The Hartford

The Hartford is a top choice for small businesses seeking reliable and affordable workers’ comp insurance. Known for its strong customer service and nationwide coverage, The Hartford offers customizable policies and additional features like business interruption insurance.

Travelers Insurance

Travelers offers robust coverage for a wide range of industries, from retail to construction. Their policies are highly customizable, allowing businesses to adjust coverage based on specific risks. Travelers also offers discounts for businesses with proactive safety programs.

AmTrust Financial

AmTrust is well-suited for small businesses and startups. Their policies are tailored to the specific needs of different industries, and they offer competitive rates with excellent support. AmTrust is particularly known for its flexible payment plans and strong claims process.

Next Insurance

Next Insurance is a digital-first provider, perfect for small businesses looking for an easy and fast application process. Their policies are designed with simplicity in mind, offering affordable coverage that can be easily managed online.

Each of these providers offers unique benefits. It’s essential to evaluate your business needs and choose a provider that aligns with your goals.

How Much Does Workers’ Comp Insurance Cost?

Industry Risk

The risk level of your industry plays a significant role in determining premiums. For example, businesses in high-risk industries like construction or manufacturing will typically pay more than those in low-risk sectors like office work.

Number of Employees

The greater number of employees you employ and the more you have, the higher your insurance will be. However, premiums are also affected by your business’s claims history. A business with a history of fewer claims may receive lower rates.

State Regulations

Each state has its own workers’ comp laws, and the premiums can vary widely from state to state. Some states have higher insurance rates due to stricter regulations and higher injury rates.

Average Cost Estimates by Industry

| Industry | Estimated Monthly Cost |

| Retail | $30 – $60 |

| Construction | $150 – $300 |

| Healthcare | $80 – $200 |

| Manufacturing | $100 – $250 |

You can lower costs by implementing workplace safety programs, reducing claims, and comparing multiple insurance quotes.

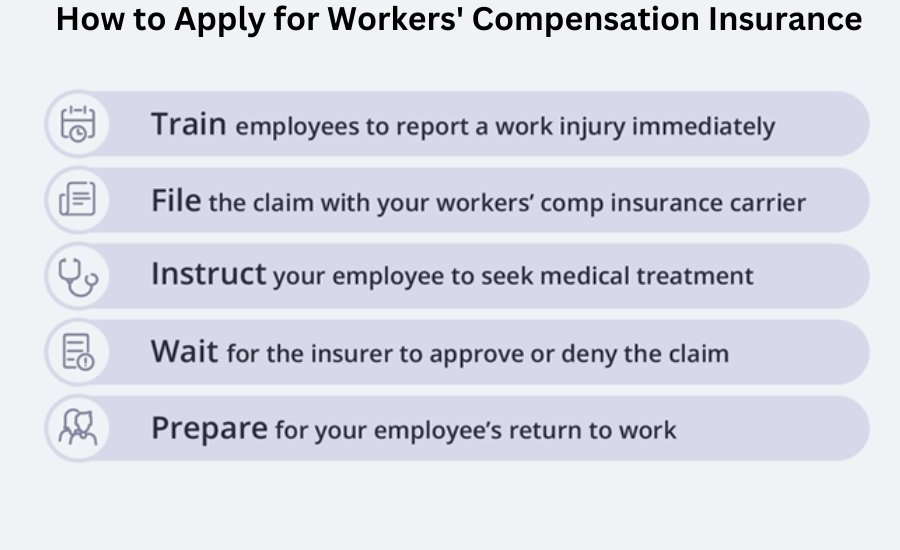

How to Apply for Workers’ Compensation Insurance

Here’s a step-by-step guide to applying for workers’ comp insurance:

Step 1: Assess Your Needs

Determine how many employees you need to cover and consider the level of risk involved in your industry. Higher-risk jobs may require more extensive coverage.

Step 2: Get Quotes

Reach out to multiple insurance providers to get a range of quotes. Be sure to inquire about any discounts or special programs that could help lower your premiums.

Step 3: Review State Requirements

Ensure that the policy you choose meets your state’s legal requirements for workers’ compensation insurance.

Step 4: Choose Your Provider

Once you’ve reviewed all the quotes and options, choose the provider that best meets your needs and budget. Finalize the policy and ensure all the details are correct.

Common Mistakes to Avoid When Buying Workers’ Comp Insurance

When selecting workers’ comp insurance, avoid these common mistakes:

- Underestimating Coverage Needs: Never settle for the minimum coverage. Ensure your policy fully covers all potential risks.

- Ignoring Claims History: A clean claims history can help you secure lower premiums. Regularly assess your safety measures to prevent claims.

- Not Reviewing Policies Regularly: Regularly review your workers’ comp policy to ensure it still meets your business’s evolving needs.

- Delaying Reporting Injuries: Report any workplace injuries immediately to ensure quick processing of claims.

By avoiding these mistakes, you’ll ensure that you have the best coverage without unnecessary financial strain.

Conclusion

Workers’ compensation insurance is a critical part of running a small business, and finding the best workers comp insurance Aupeo will give you peace of mind and financial security. As we move into 2024, the importance of staying updated on insurance options and industry regulations cannot be overstated. Be sure to compare providers, evaluate your business’s needs, and choose the coverage that offers the best protection for your employees.

FAQs

Q: What is workers’ compensation insurance?

A: Workers’ compensation insurance covers medical costs and lost wages for employees injured on the job.

Q: How do I find the best workers’ comp insurance?

A: Compare different providers, coverage options, and customer reviews to choose the best plan for your business.

Q: Does workers’ comp insurance cover all workplace injuries?

A: It covers most job-related injuries, but claims may be denied for misconduct or non-work-related incidents.

Q: How much does workers’ compensation insurance cost?

A: Costs depend on business size, industry risk, and coverage limits, so getting multiple quotes is recommended.

Q: Is workers’ comp insurance required by law?

A: Yes, most states require businesses to have workers’ comp insurance, but rules vary by location.

Q: Where can I get the best workers’ comp insurance Aupeo?

A: You can find reliable providers online or consult an insurance expert for the best coverage options.

Visit Out: Coyyn-com-digital-capital